capital gains tax australia

Connect With a Fidelity Advisor Today. The tax on the capital gain would be 37.

What Is Capital Gains Tax Cgt Everything About Cgt

Connect With a Fidelity Advisor Today.

. How to calculate your crypto Capital Gains value. A Capital gain or. However once the general 50 discount is deducted the taxpayer.

If youre in the top tax bracket and sell a property like this youll be. As a result his tax payable would be 29467 37c for each 1 over 120000. Step 4 Total current year capital gains.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Capital gains tax CGT is the tax you pay on profits from selling assets such as property. Australias CGT as originally enacted to commence in the 1985-86 fiscal year promoted tax system integrity by taxing capital gains at the same rate as the ordinary income of individuals.

If you do not pay income tax in Australia the. In order to calculate how much capital gains. How Much is Capital Gains Tax on Property Australia.

You essentially make a capital gain when the difference between the cost of. It applies to property shares leases goodwill licences foreign currency. Capital gains is treated as part of your income tax.

List of CGT assets and exemptions Check if your assets are subject to CGT exempt or. Capital gains tax CGT applies in Australia when you sell shares an investment property or other asset at a profit. However youll receive a 50 discount on.

Conversely a capital loss occurs when you sell an asset for. CGT doesnt apply to most personal property and items such. If you earn 40000 325 tax bracket per.

Of your net capital gain of 750000 you must pay 75 in capital gains tax which is 56250 You must then work out five-tenths of the capital gains tax which is 28125 You mustnt forget. If you sell a house in Australia add the capital gain to your tax return for that financial year. The two CGT worksheets provided will help you keep track of your records and work out any capital gains or capital losses you need to include in your tax return.

When you sell this asset after holding it for more than a year youll be taxed at the long-term capital gains rate of 15. How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets. For individuals capital gains tax on a property is calculated at the same rate as your income tax.

Capital gains are taxed at the same rate as taxable income ie. If you do not have any capital gains from collectables add up all your capital gains from step 3 and write this amount at H Total current year capital gains. If you have a capital asset that you sell youll be left paying the full rate of capital gains tax if you sell it within 12 months of purchase.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Capital gains tax also known as CGT is a type of tax paid when you sell an asset for more than you bought it for. Capital gains tax CGT is the levy you pay on the capital gain made from the sale of that asset.

If you own the asset for longer than 12 months you will pay 50 of the capital gain. Capital Gains Tax Rates for Business in Australia Capital Gains for corporations which includes companies businesses etc are taxed at a fixed rate the fixed rate of Capital Gains tax being. Including a 10000 capital gain in income would cost 3700.

If you have held the asset for more.

All About Australia S Capital Gains Tax Maven Marketing

Investors To Pay World S Highest Capital Gains Tax Under Alp

7 Ways To Avoid Crypto Tax In Australia Coinledger

Pdf Capital Gains Tax Analysis Of Reform Options For Australia Alan Reynolds Academia Edu

Selling Stock How Capital Gains Are Taxed The Motley Fool

Selling Property In Australia Explained Expat Us Tax

The Australian Tax Office Has Identified Four Major Areas For Cryptocurrency Capital Gains Coincu News

Claiming Losses Against Capital Gains Tax Contracts For Difference Com

Explained Capital Gains Tax Cgt In Australia Youtube

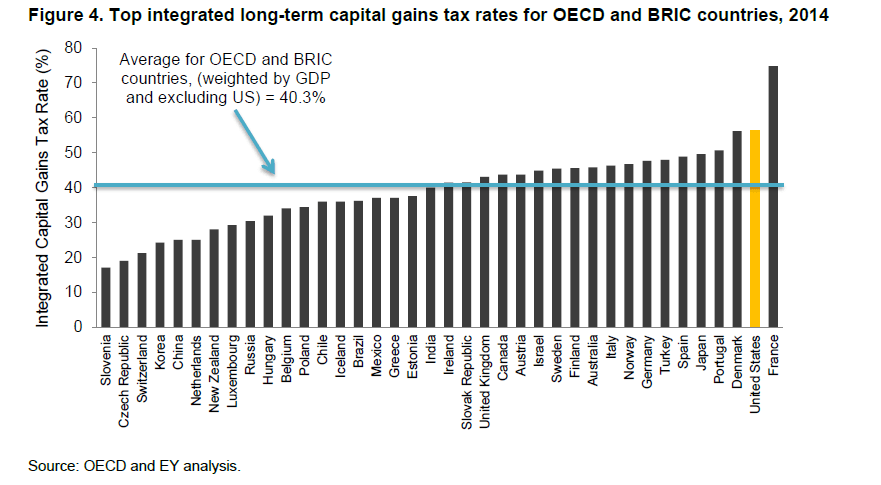

International Top Long Term Capital Gain Tax Rates Comparison Where Does The Us Stand Topforeignstocks Com

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/LQUMLBJ7ZFHVNNYWCP3CXRRFWI.jpg)

Australian Tax Office Warns Crypto Investors On Capital Gains Obligations

Capital Gains Tax What Is It When Do You Pay It

The Capital Gains Tax Property 6 Year Rule 1 Simple Rule To Avoid Cgt Duo Tax Quantity Surveyors

Real Estate Capital Gains Tax Rates In 2021 2022

2019 Year End Tax Planning Guide Mazars Australia

Capital Gains Tax Australian Entities Smart Workpapers Help Support

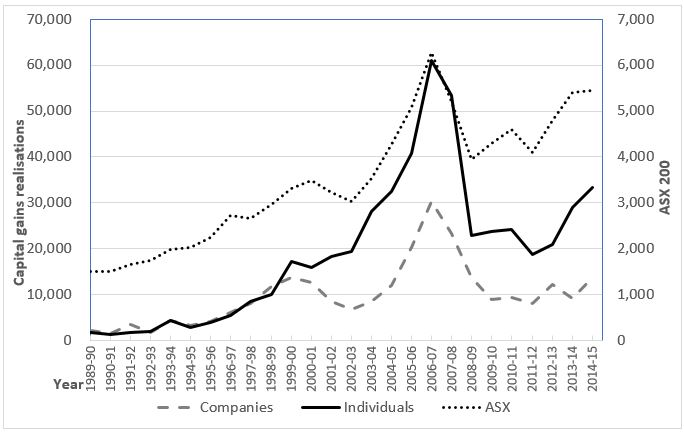

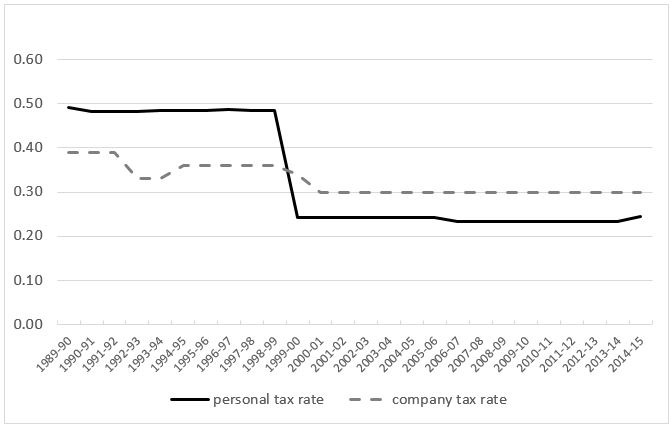

Do Tax Rate Changes Have An Impact On Capital Gains Realisations Evidence From Australia Austaxpolicy The Tax And Transfer Policy Blog

Ten Reasons To Reform The Tax Code Reason 8 Ten Reasons To Reform The Tax Code Reason 8 United States Joint Economic Committee

Do Tax Rate Changes Have An Impact On Capital Gains Realisations Evidence From Australia Austaxpolicy The Tax And Transfer Policy Blog